Option contract price calculator

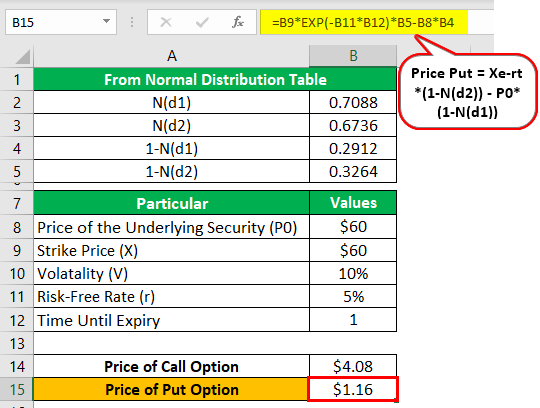

You buy a Put contract of A with strike price 100 paying. The Profit at expiry is the value less the premium initially paid for the option.

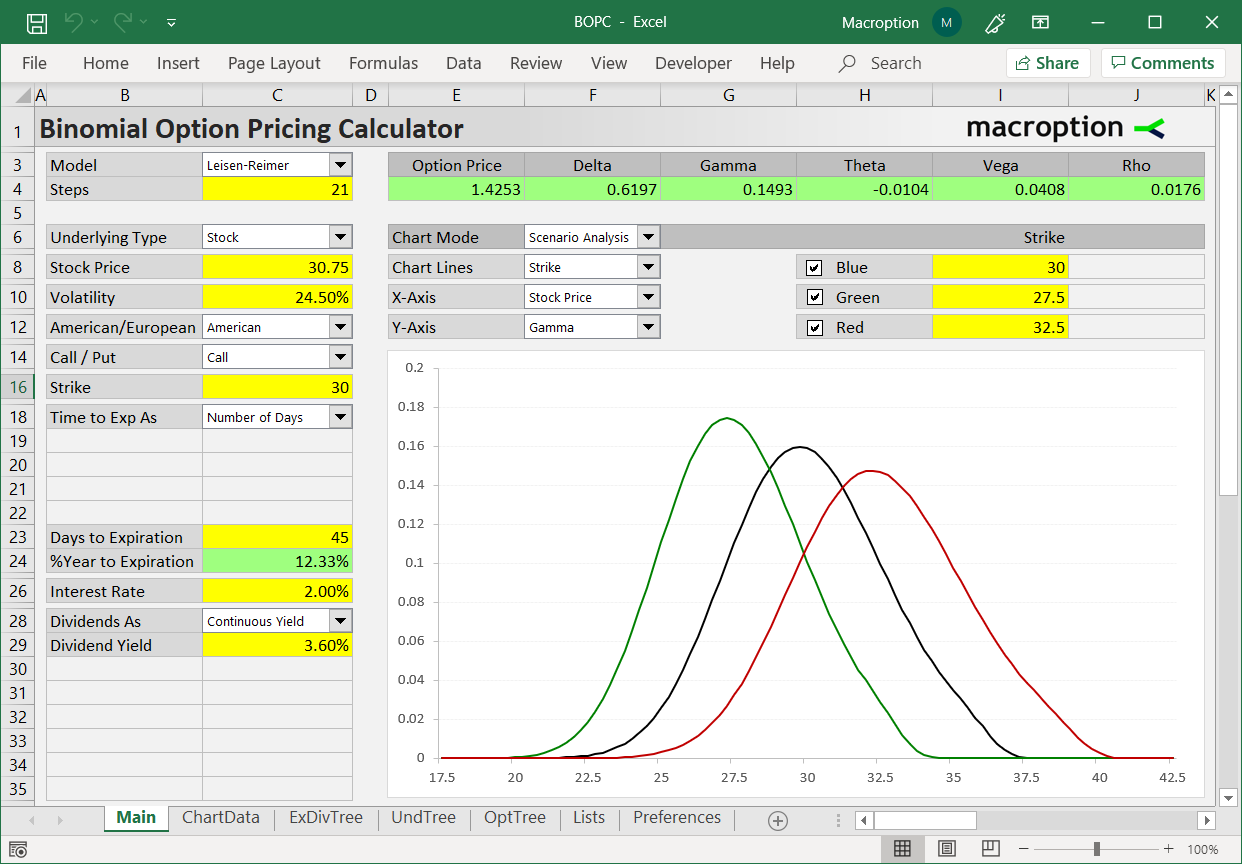

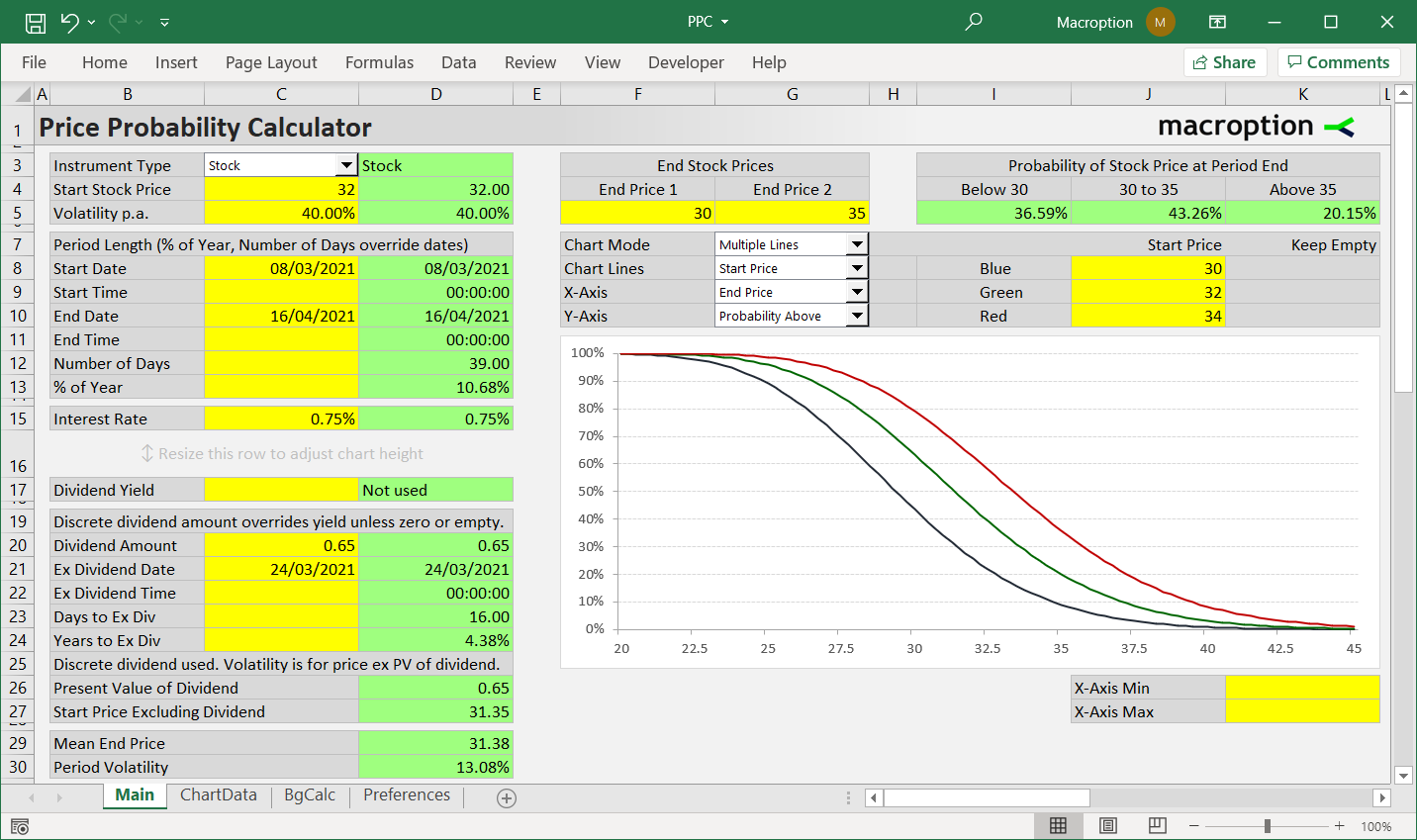

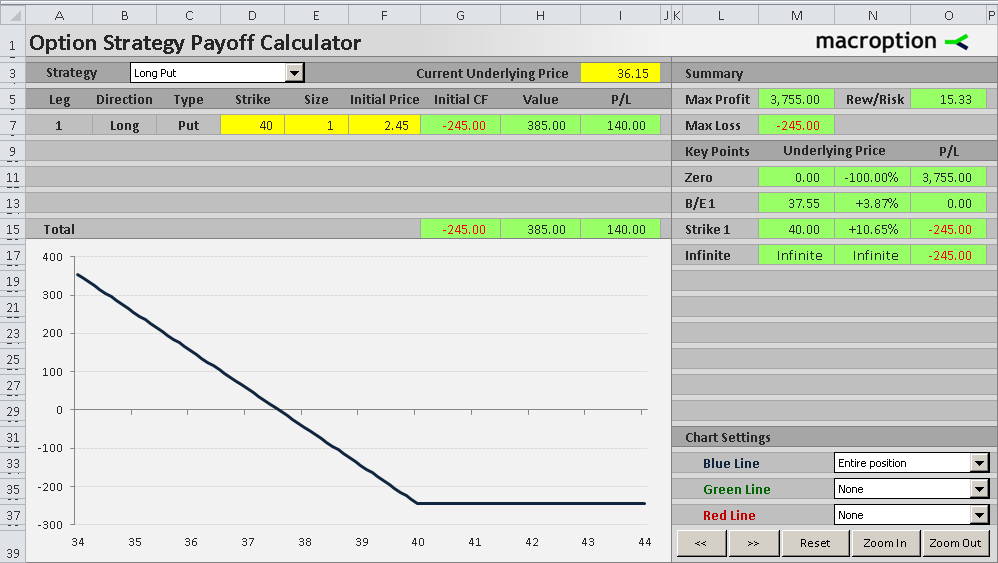

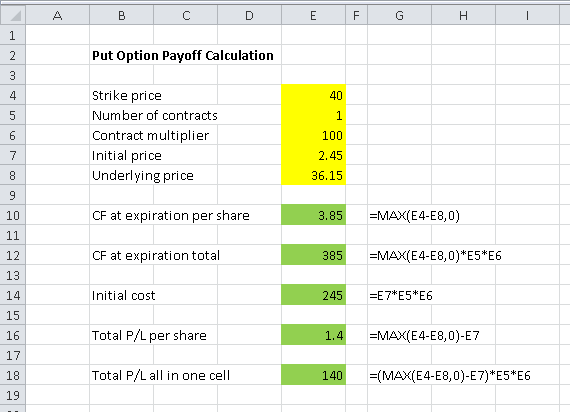

Macroption Option Calculators And Tutorials

The calculator allows you to enter your own.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

. The long put calculator will show you whether or not your options are at the money in the money or out. Stock Symbol - The stock symbol that you purchased your. An options price is primarily made up of two distinct.

Put Option Calculator is used to calculating the total profit or loss for your put options. Copies of this document may be obtained from your broker from any. In-the-Money or ITM option strike prices will always have positive intrinsic value.

The term contract in this case seems intimidating. Use the Options Price Calculator to calculate the theoretical fair value Put and Call prices Implied Volatility and the Greeks for any futures contract. An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

The inputs that can be adjusted are. Calculate the future options prices. At-the Money or ATM strikes and.

Investing in stock options starts with agreeing to a stock option contract. Use Options Calculator to calculate options prices with more accuracy. Your Free Options Prices calculator.

The options calculator is an intuitive and easy-to-use tool for new and seasoned traders alike powered by Cboes All Access APIs. The long call calculator will show you whether or not your options are at the money in the money or out. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the.

The strike price is a threshold to determine the intrinsic value of options. Price Per Choice This is actually the price each a single stock option. Customize your inputs or select a symbol.

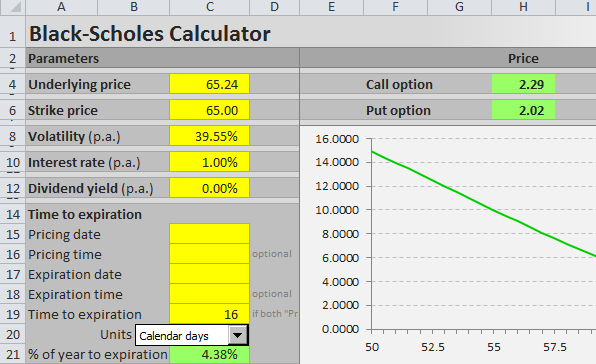

To calculate the theoretical value of an options premium or implied volatility. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or. This calculator to determine the value of an option.

Youre not legally obligating yourself to buy shares at the. Find the best spreads and short options Our Option Finder tool. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

In other words the particular contract gives typically the option buyer. Simply enter any brokerage fees you will have for buying or selling options contracts. The option calculator uses a mathematical formula called the Black-Scholes to predict and analyse options.

Generate fair value prices and Greeks for any of CME Groups options on futures contracts or price up a generic option with our universal calculator. The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model. Cash Secured Put calculator addedCSP Calculator.

Poor Mans Covered Call calculator addedPMCC Calculator. Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. Investment are sold inside contracts or a lot of 100.

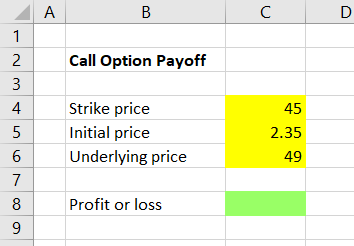

Call Option Calculator is used to calculating the total profit or loss for your call options. With this input the stock options calculator will be able to display your exact return target return and. Options contracts can be priced using mathematical models such as the Black-Scholes or Binomial pricing models.

Macroption Option Calculators And Tutorials

Option Price Calculator Calculate Bs Option Price Greeks

Call Option Calculator Put Option

Calculating Call And Put Option Payoff In Excel Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Black Scholes Excel Formulas And How To Create A Simple Option Pricing Spreadsheet Macroption

Options Profit Calculator Options Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

Calculating Call And Put Option Payoff In Excel Macroption

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

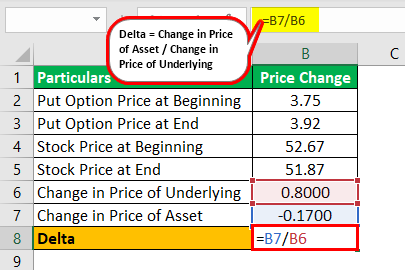

Delta Formula Definition Example Step By Step Guide To Calculate Delta

Understanding The Binomial Option Pricing Model

Put Option Payoff Diagram And Formula Macroption

Pricing Options Strike Premium And Pricing Factors Nasdaq

Put Option Payoff Diagram And Formula Macroption